single tier dividend

Special Single-Tier Dividend of 90 sen per ordinary share How to be entitled To be entitled for any of the above you need to purchase the shares one trading day before the ex-Date. TAXATION 2 ASIGNMENT ADILAH RAZAK AMANINA ABDULLAH HANIS TAMANURI ZAZNY HANADZIR LIYANA.

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

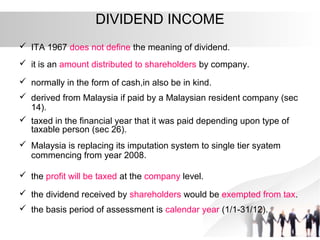

THE Budget 2008 announcement that as of Jan 1 2008 the treatment of corporate dividends will be changed with the adoption.

. Deloitte Touche Tohmatsu Tax Services Sdn Bhdmanaging director Ronnie Lim defines the new singletier corporate tax system STS and compares it. Top Mod and Low refer to top. Foreign dividends received in Singapore by resident individuals.

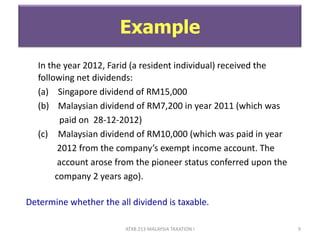

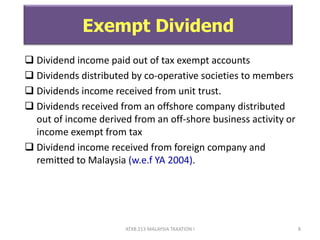

View Single tier dividendpptx from FINANCE BWFF2013 at Northern University of Malaysia. Ad DividendInvestor is an AwardWinning Dividend Screening Platform. Exempt dividend is distributed out of income that has been exempted from tax at the company level while the single-tier dividend is distributed.

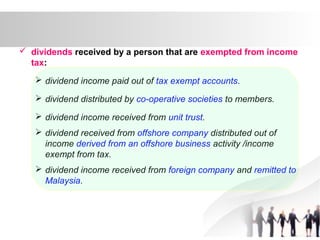

Corporate shareholders receiving exempt single-tier dividends can in turn distribute such dividends to their own shareholders who are also exempt on such receipts. The single-tier dividend income distributed is tax exempt in the hands of the recipient paragraph 12B of Schedule 6 of the ITA and bond interest received by the foreign investor is exempted under paragraph 33A of Schedule 6 of the ITA. A FINAL single-tier dividend of 1 sen per share was approved for 7942 shareholders of the PBA Holdings Berhad PBAHB today.

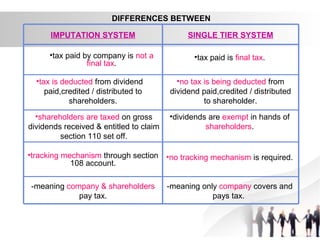

Where all dividends received from Malaysia Company will be exempted from tax in the hand of shareholders. Dividends are exempt in the hands of shareholders. Malaysia is under the single-tier tax system.

The taxation of dividends in Malaysia is subject to a single-tier system and those dividend payments made by companies under this system are not subject to tax. Capital gains however even when achieved via an ECF platform is a more nuanced issue. Before compulsory single tier tax system 2012-2013.

Dividends paid to shareholders by a Singapore resident company excludes co-operatives under the one-tier corporate tax system as the tax paid by a company is final. Chief Minister Chow Kon Yeow said the total payout would amount to RM331 million. PBAHB has been paying dividends annually since 2002 he said in a statement.

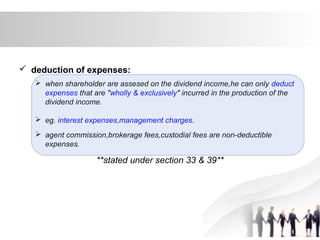

I A company is required to utilize all or disregard the balance in the section 108 account before declaring single tier dividend to its ordinary shareholders. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. An interim dividend is a dividend payment made before a companys AGM and final financial statements.

Malaysia has long shifted fully on Single. If an individual resident in Singapore receives foreign-sourced dividends through a partnership in. Ii Where the date of payment for each category of dividend is different separate dividend vouchers should be prepared.

This declared dividend usually accompanies the companys interim financial. C An interim single tier dividend of 15 sen per share amounting to RM62217748 from INS 510 at Universiti Teknologi Mara. According to this regime the corporate income tax imposed on a companys profits is in the form of a final tax and the distributed dividends are exempt from tax in the hands of the shareholders.

By KANG BENG HOE. Malaysia is under the single-tier tax system. Generally the following dividends are not taxable.

In 2019 the yield was 065 Sen. Single Tier Dividend In Malaysia. Companies may declare single tier exempt dividend that would be exempt from tax.

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability.

Definition Of Five Major Tax Systems Download Scientific Diagram

Kimberly Clark A Recession Resistant Dividend Aristocrat Intelligent Income By Simply Safe Dividends

How To Build A Dividend Portfolio A Dividend Portfolio Allocation Strategy

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

.jpg)

Knowthymoney Dividend Statement For Tax Return

Chapter 5 Non Business Income Students

Impacts Of The Self Assessment System For Corporate Taxpayers

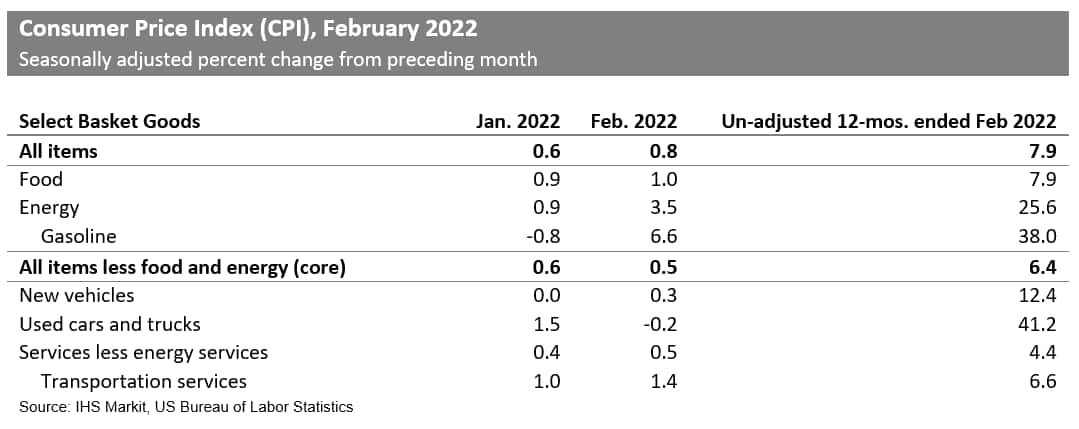

Inflation Impact On Dividend Distributions Ihs Markit

Chapter 5 Non Business Income Students

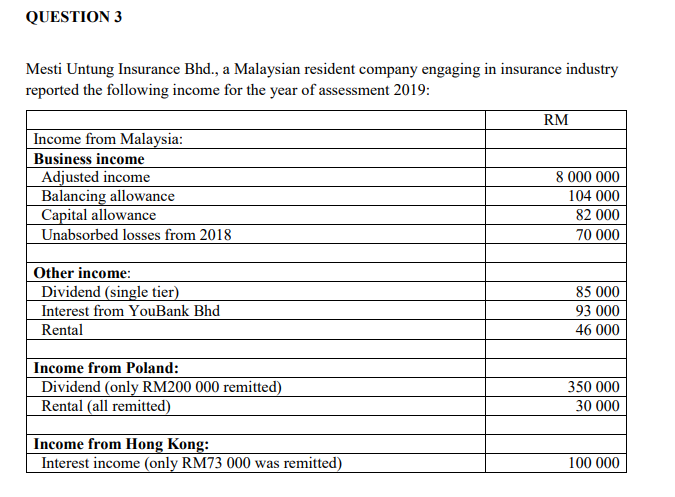

Question 3 Mesti Untung Insurance Bhd A Malaysian Chegg Com

Taxation Principles Dividend Interest Rental Royalty And Other So

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Single Tier Dividend System By Faizatul Amira Pisol

Taxation Principles Dividend Interest Rental Royalty And Other So